Updated October 2025

We've combined statistics from the past few months and our experience working with clients to give you a market update for the city and the suburbs.

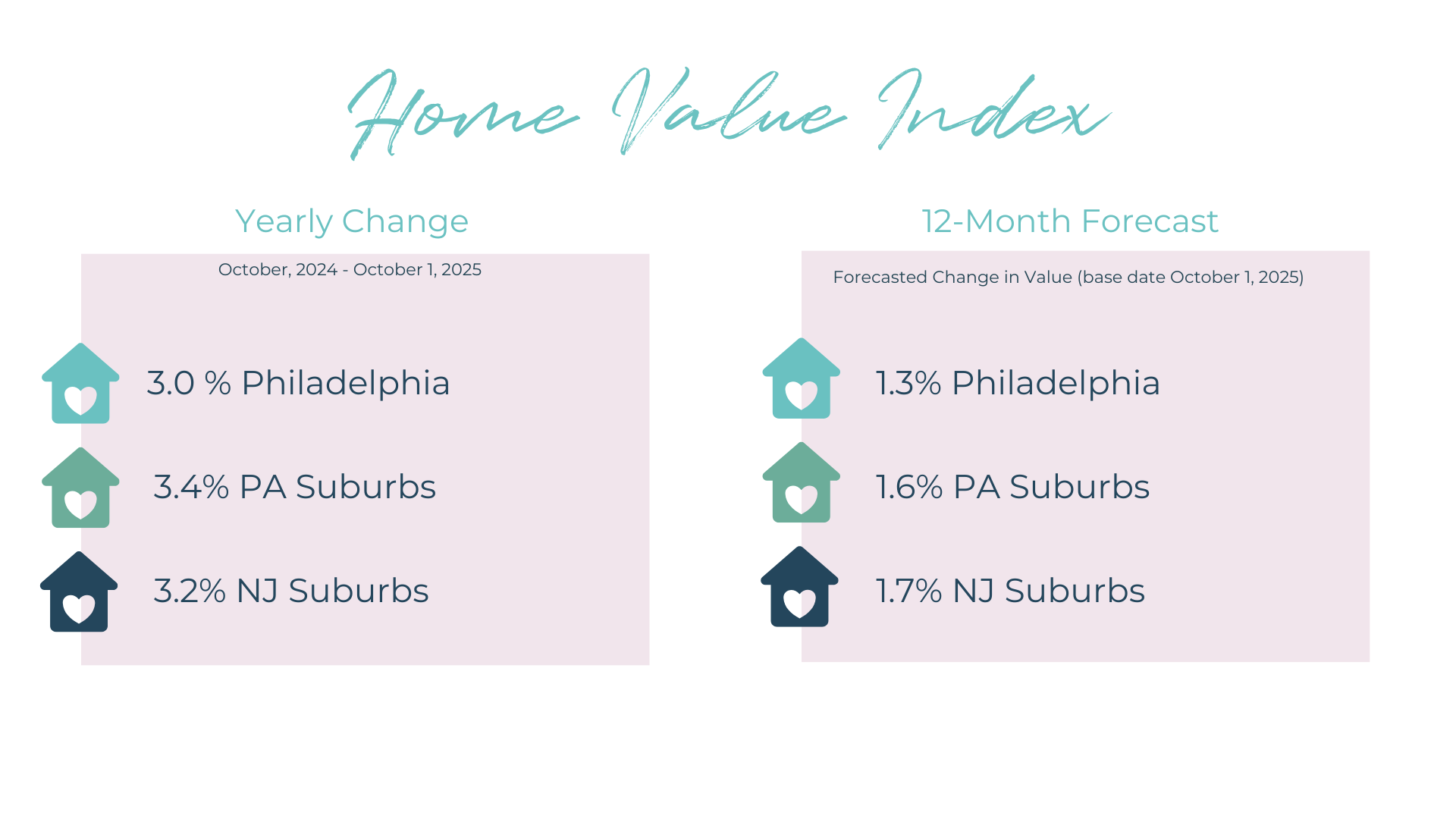

HOME VALUES

PHILADELPHIA

The home value index* at the end of August was $232,398, a 3.0% increase compared to this time last year.

While this is city-wide, the yearly changes by zip code range anywhere from -2.7% (in 19102) to +7.6% (in 19153). As always in Philly, submarkets are important when it comes to numbers.

SUBURBS

In all the surrounding PA counties, the change since last year increased: Bucks +4.2%, Chester +4.4% , Delaware +2.1%, Montgomery +2.8%, bringing the home value indexes to Bucks $507,666, Chester $561,125, Delaware $359,086, Montgomery $481,492.*

In all the surrounding NJ counties, the change since last year increased: Burlington +2.6%, Camden +4.4% , Gloucester +3.6%, Salem +2.3%, bringing the home value indexes to Burlington $417,446, Camden $350,047, Gloucester $376,758, Salem $291,120.*

Nearly all zip codes in the suburban counties continued to show positive yearly changes in value.

SUPPLY AND DEMAND

When the home supply exceeds the buyer demand, it’s considered a buyer’s market. When this happens, sellers have high competition and the leverage of the market leans toward buyers. You see more buyer concessions, like seller’s assists and home sale contingencies. On the flip side, a supply of homes that cannot meet the buyer demand is considered a seller’s market. Under these market conditions, buyers are in competition and the leverage leans toward the seller’s. This is what we have seen amplified in the past couple years, where it’s common to see low days on market, multiple bids, and waived inspections. Looking at the measurements for supply and demand helps predict how the market will react so you can be prepared to enter the market as a buyer or seller.

INVENTORY

Both Philadelphia and surrounding counties have had historically low supply of inventory in the past few years. Even before the pandemic, inventory was hitting all-time lows in Philadelphia. In fact, there were more new listings in both 2021 and 2022 than there were in 2019. This combined with high buyer demand created a high absorption rate. Most of the new listed homes were purchased quickly, leaving all-time low inventory on the market. This year, however, we have seen almost every county increase in new listings, a change from last year when we saw submarkets greatly differing from each other. The number of new listings this year to date in Philadelphia compared to the same time period in 2024 increased 4%. The suburbs also welcomed a much-needed increase in listings year to date as compared to 2024: Bucks County +6%, Chester County +8%, Delaware County -2%, Montgomery County +4%, NJ Counties +6%.

So what does this increase in listed homes mean? Is it a buyer’s market? The MSI can help us determine the answer.

MONTHS SUPPLY OF INVENTORY

A number that helps quantify demand vs supply is the month's supply of inventory (MSI.) It combines the inventory and number of listings. The MSI represents how many months it would take to sell all the homes on the market based on its current sales pace (the demand). An MSI of under 5 usually reflects a seller’s market, 5-7 a balanced market, and > 7 a buyer’s market.

Philadelphia: The MSI was 4.9 at the end of September.*

This is about where it has been for most of the year, between 3-5. Of course, when you look at submarkets in Philadelphia, there are differences when you compare zip codes. The MSI at the end of September in zip code 19107 was 9.6, indicative of a buyer’s market. In 19118, the MSI was 3.1 which leans more towards a seller’s market.

PA Suburbs: The MSI was 1.9 at the end of February.*

NJ Suburbs: The MSI was 2.1 at the end of February.*

This means it would take about two months to sell all the inventory in the suburbs based on the current demand. For reference, this is where the MSI has been for most of the year.

In those areas with higher MSI numbers, it’s more likely that seller’s assists and home sale contingencies are accepted in contracts. In areas with lower MSI numbers, it’s more likely to encounter a bidding war.

RATES AND AFFORDABILITY

It’s true that rates and inflation are factors in buyer affordability and demand. A 1% difference in a 30-yr mortgage translates to a $75 difference per month for every 100K you borrow. With the low inventory, we know some buyers have been in the market for a while now.

In September, the rate on a 30-yr fixed mortgage remained less than 6.5%. This number can vary based on your debt to income ratio, your down payment, and credit. So while you may read about 6.3% rates, the range may start at somewhere close to 6%.

And remember, rates are not everything when it comes to affordability. There are ways to offset extra costs, like buying down points, seller’s assists, or using loan programs that offer grants. There are also Adjustable Rate Mortgages (ARMs) that have lower rates than conventional mortgages at the beginning of your loan. Talking one-on-one with an agent about affordability is an excellent way to remove tunnel vision when considering rates. They will be able to give you a target purchase price based on your monthly budget, or vice versa. They can also pair you with a lender that is the best fit for you.

Keep in mind that lowering rates increases the buyer demand. The 30-yr fixed mortgage rate recently decreased from 6.6% in the first week of August to 6.3% in the first week of October. Over the same time period, the number of applications for a 30-yr fixed mortgage increased by 54%.

FORECAST FOR HOME VALUE

Even if areas show differences in supply and demand, there is uniformity in the home value forecasts for the next 12 months. By county: +1.3% in Philadelphia, +1.8% in Delaware, +1.6% in Montgomery, +1.6% in Bucks, +1.6% in Chester, +1.6 in Burlington, +1.6 in Camden, 1.8% in Gloucester, 1.6% in Salem* (Zillow Home Value Forecast). The uniformity of these predictions is a sign that the market will not be jumping up or down. This is good for both buyers or sellers that have been trying to catch the “best time” to buy or list.

WHAT TO EXPECT FOR BUYERS AND SELLERS

Inventory has increased in the city and surrounding counties, and rates have decreased, which is a great relief for buyers. If you’ve been waiting for an advantageous time to purchase, it may be now, especially in a submarket that favors buyers right now. There is a better chance you’ll be able to buy with a home sale contingency, negotiate repairs, or get a seller’s assist. Remember, submarkets are the name of the game in the Philly metro. Your competition and affordability may vary depending on where and what you are looking for in a home. Certain areas and price ranges are still showing high competition. In other areas, homes have been staying on the market longer. These are areas where you’ll have more leverage as a buyer.

As a buyer in the suburbs, competition remains high even with an increase in inventory, so you may encounter listings with multiple bids. If you are thinking about moving from the city to the suburbs, make sure you know the market you are entering. Your agent can show you the data and prepare you so you’re ready when your perfect home hits the market.

For sellers, inventory is still considered low. In the suburbs, the market still favors sellers, however, buyers are not reacting the same way they did last year. For example, the average days on market across all surrounding counties has increased 15% compared to last year. In the city, new listings are being absorbed at a steady (not rapid) pace, reflecting a more balanced market. Listing your home with market pricing and perfect presentation gives you the best advantage to sell in this market. When you sit with us for a listing appointment, we pull data specific to your zip code or neighborhood, which may be different from the city-wide or suburb-wide data. This hyper-local report can better predict your home’s competition. We can help you put together a pricing strategy based on statistics and your motivation.

Philly Home Girls agents want to empower you with all the knowledge you need to make a decision about your real estate goals. We are ready to be your in-market leader, expert negotiator, fiduciary advocate, and overall guide through this process. If you are curious about the home buying or selling process or want to learn more about the current market, we’d love to set up a chat to answer all your questions.

*Data from Zillow.com | ** Data from BrightMLS | ^ Lindy Institute for Urban Innovation at Drexel University| 1 Data from Mortgage News Daily

What do you do when you’ve inherited a house? How do you sell a home from a loved one’s estate? What will happen with your home after you pass away? These are common questions we get in this industry. To help answer them, we sat down with Steven Zelinger, an attorney that specializes in estate planning and probate.