With all the upgrading and home renovations going on, it’s time to discuss Home Equity Loans and Home Equity Lines Of Credit (HELOC). Unlike refinancing, which you can read about in our refi blog, both of these options allow you to borrow money against the equity of your home without having to get a new mortgage. Here are some of the basics to help you with planning to upgrade your current home and/or move into a new one.

What’s the difference between the two?

A Home Equity Loan is a lump sum that is loaned to you with a fixed interest rate. It feels very similar to the model of your mortgage. Payments start coming due the month after closing on this loan and are based on the whole amount of the loan. Usually they have a fixed interest rate so payments are the same amount every month for the life of the loan.

A Home Equity Line of Credit (HELOC) is used the same way as a credit card. It’s a line of credit that's available when you need it except your home is the collateral the credit is based on. Draw money from that line of credit as needed, and only pay monthly interest on the balance you draw. Mostly these loans have an adjustable interest rate, so the rates associated with the loan go up and down. Unlike a credit card, if you can’t make your payments your home is at risk. Also unlike a credit card, the interest paid on your HELOC can be tax deductible depending on the current tax regulations.

It’s important to remember that both of these options are in ADDITION to your primary also known as the lien, loan or mortgage in the 1st position. The HELOC and Home Equity Loan are both considered a 2nd mortgage, which uses your home as collateral. As mentioned, if you don’t stay current on these types of loans, the bank can move forward with foreclosure on your home. The proceeds they receive will pay off the liens in order of position. Primary mortgage 1st, line of credit 2nd, and then anything else you might be on the hook for like back taxes.

As these programs are usually held by the bank who originates them, that lender may be fairly picky about what is needed to qualify. Some lenders may require more, but if you meet these basic requirements, you can be confident in starting the conversation with your bank.

You have at least 20% equity in your home (this means your home is worth 20% more than the total amounts of mortgages or liens you owe).

Have a credit score in the mid 600’s, higher will secure even better rates

Your DTI (debt to interest) ratio is less than 43%

You have steady, reliable income

Have consistent payment histories on all your obligated debts like credit cards and student loans.

What can I use this money for?

Most lenders will let you use the loan or line of credit for just about anything. The bank will inquire what your intended use is. It could be renovations to your current home, a down payment for an investment property, a new car, debt consolidation (HELOC rates are way lower than credit card interest rates), or even tuition.

How much dough can I get with either option?

For either a Home Equity Loan or HELOC, the majority of banks will allow you to borrow up to 80% of your home value and some will even stretch that to 90%. That doesn’t mean you should always go for the max possible. Plan for what you can manage in your monthly expenses.

To figure out your loan to value ratio (LTV) divide your mortgage’s outstanding balance by the homes’ current market value. Most lenders want to see an LTV of 80% or less. Better yet, let this handy home equity calculator from Bankrate.com do the work for you and figure out how much you could potentially borrow.

A note to remember: Approval for this type of loan or credit line is based on your income. For example, if you’re retired and have $500,000 worth of equity in your home, you most likely will not be approved for a HELOC or Home Equity Loan. This is because they are bank-owned programs and they are income-based.

How do I know which is right for me?

A Home Equity Loan is best for people who are going to use the entire loan balance right away. For example, as the down payment to buy a new property. Although the interest rate for a Home Equity Loan may be higher than your mortgage rate, you’ll know exactly what your monthly payment will be for the length of the loan and how that payment fits into your budget and future plans.

Remember with a HELOC, you only pay on the amount of credit you use. Sometimes the minimum monthly payment is interest-only, meaning, you’re not paying any of the principal on the loan. This is ideal if you’d like to give yourself a short-term loan, to pay off a high-interest credit card for example. Or use it as a down payment on a rental property, then let the rental income pay it off. Once it’s paid down, use it for any maintenance or repair if emergencies arise. A HELOC is best if you have regular financial windfalls, such as bonuses, or commissions, or gigs, allowing you to pay off bigger chunks at a time so you tackle the principle as quickly as possible and don’t get in over your head.

Our friend Andy Krider, Senior Loan Officer at TD Bank, cautions his clients to “not hold a big balance on a HELOC and always plan to pay off in 1-2 years. This will allow you to take advantage of the low interest that is better than a typical credit card but keep you on track and responsibly paying down the line of credit in the most efficient way possible.”

Still confused! Help!

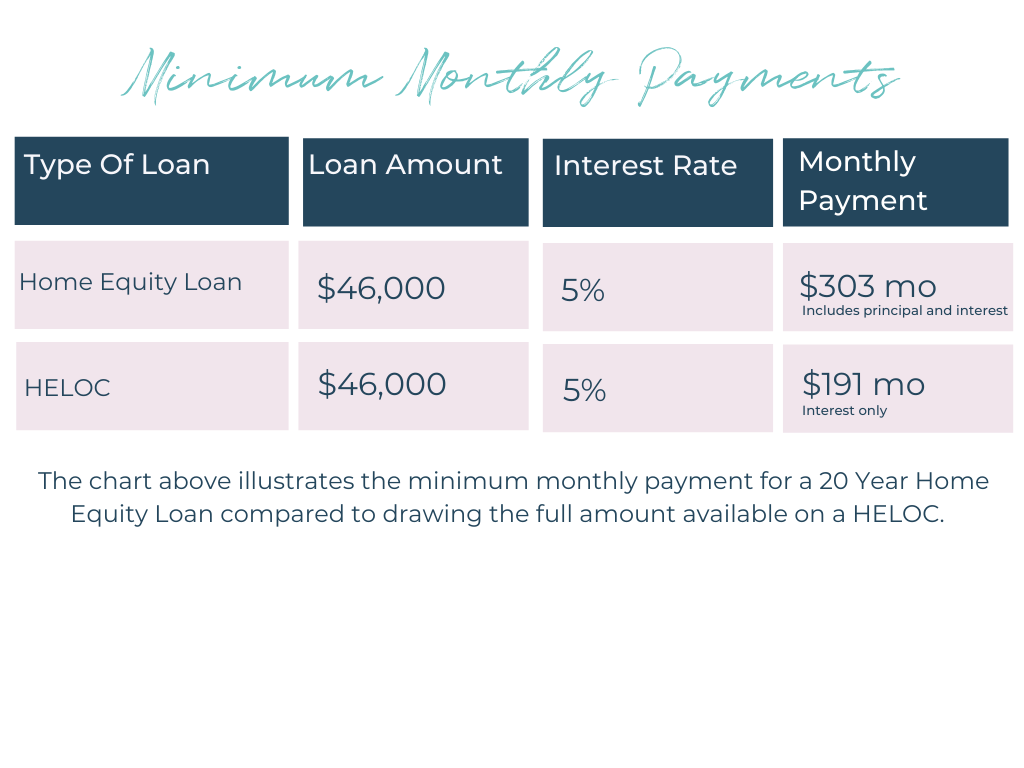

Say you need a new roof that is going to run you about $12k. You’re also toying with the idea of making some home improvements. Your estimate for reno’s came in at $34k. You’re looking to borrow a total of $46,000.

With a Home Equity Loan, you would get that lump sum of $46k at once. Your monthly payments would be calculated and you start paying on the total at the start of your loan, no matter when the roof happens or if renovations take place. The benefit is that you have the money in the bank to use how and when you like, and you know exactly what the monthly payments are.

A HELOC allows you to draw from the credit line as you need. Your roof is a must-have, you draw $12k and pay monthly on that amount only. Your holiday bonus shows up, and you pay the remaining balance off. Six months later when your home renovations are designed and you have the crew standing by, you draw the $34k. Again, you only then start making monthly payments once you have drawn that money from the HELOC.

Perhaps your renovations don’t come to fruition and you decide you’re going to move up instead. You never used that line of credit, and haven’t had to pay any interest on it all this time, it’s been sitting there waiting for you to use it as the down payment for your new house. You find a house you like, make an offer without a home sale contingency. Use the equity from your home (the HELOC) as your down payment. Close on your new home, move in. Then sell your old home and pay the HELOC off at closing with the rest of that mortgage sitting there is the 1st lien position we talked about. Sometimes we can do this so quickly and seamlessly that you don’t even have to make an interest-only payment on the HELOC.

Let’s do it!

HELOCs and Home Equity Loans really are helpful if you have a plan. If you’re thinking about home renovations or looking for money to purchase an investment property, a HELOC may be a perfect solution. It has a far better rate than a personal loan or credit card.

To find a lender, Andy Krider suggests reaching out to where you bank first and then shopping around from there. Sometimes the bank who holds your first mortgage is the best resource as they know you and your payment history well. Unlike a mortgage, this is an opportunity where it’s smart to shop around. Find the best rates, and what the banks are offering in terms of the loan.

If you still have questions, we’re here! Feel free to drop us a line or give us a call and we can get you on the road to those home renovations. Just promise that you’ll invite us over for the before and afters!

Saving money for a downpayment and closing costs is the # 1 reason people are holding off on purchasing a home. PHG agent Rachel Shaw came up with a trusty list of some of her favorite homebuyer assistance grants and loan programs. With a little help, your dream of owning a home may not be as far off as you thought!